Landing Page – 2024 Guide to Navigating People Analytics eBook

The 2024 Guide to Navigating People Analytics Your Guide to…

read more >

The 2024 Guide to Navigating People Analytics Your Guide to…

read more >

Watch the On-Demand Webinar Below! Is your DEI programming effective?…

read more >

Introduction In today’s business climate, you’d be hard pressed to…

read more >

The human brain is wired to process information visually, making…

read more >

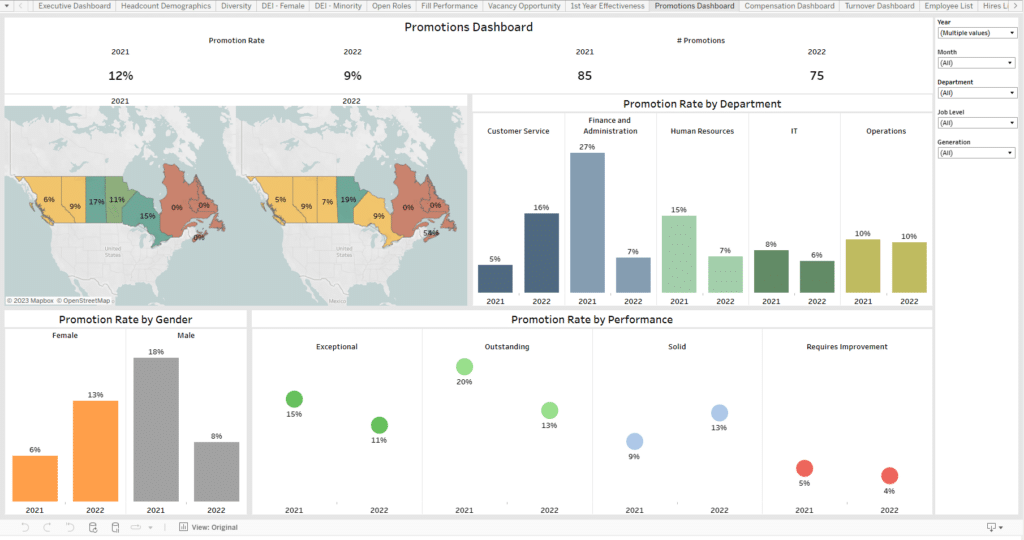

People Analytics Dashboards for People Leaders Discover the transformative potential…

read more >

How do you know where to invest recruiting dollars? Talent…

read more >

CBRE: An HR Analytics Case Study We chatted with Méline…

read more >

Download the Infographic Employee engagement is critical to a thriving…

read more >

With people analytics, human resources teams reclaim time and resources.…

read more >

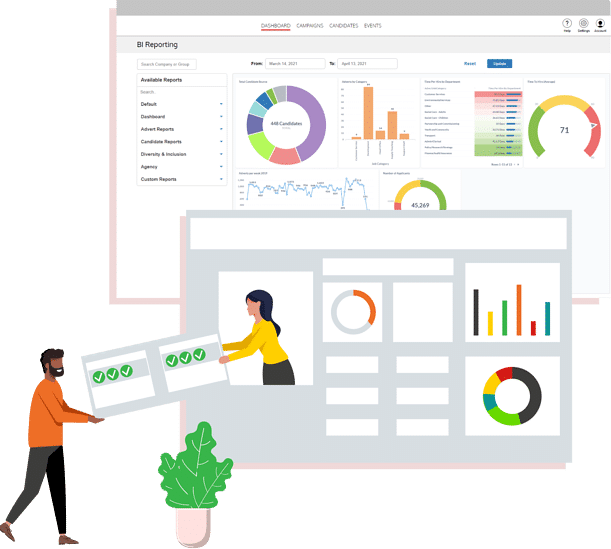

No more spreadsheets. Customized reporting at your fingertips. Your Greenhouse…

read more >

Unleashing the Power of Systemic HR and People Analytics …

read more >

Maximizing Diversity, Equity, and Inclusion (DEI) Programs: The Role…

read more >

2024 is a big year for HR. According to the…

read more >

Picture this: a top performing employee keeps their head down…

read more >

It would seem that talent analytics is a must- have…

read more >

“What is people analytics?” Brilliant question – and one business…

read more >

Wondering why a killer people strategy has become so relevant…

read more >

"Workforce planning is the process of leveraging data to ensure…

read more >

Talent development calls for a strategic approach. There’s no leaving…

read more >

HR strategy in 2024 is about crafting a collection of…

read more >

Talent retention is a critical aspect of HR. It impacts…

read more >

In his Why It’s Time For A New Era In…

read more >

Watch Panel Webinar! Don’t miss this engaging panel discussion (webinar) on…

read more >

Navigating the complex world of HR operations can be daunting.…

read more >

Download Infographic Data-driven HR involves the integration of people data…

read more >

Which are you delivering? Definition of People Analytics: Using both…

read more >

Get more out of your UKG Data While UKG and…

read more >

Workday for People Analytics - Made Easy Heard from Workday…

read more >

“To win in the marketplace you must first win in…

read more >

Boston, MA – HireRoad, a leading provider of cloud-native end-to-end…

read more >

What lies beneath the surface is key Above the surface…

read more >

For Faster, Smarter, and Better Hiring Decisions You invest heavily…

read more >

Download the HRBP Reporting and Analytics Infographic This infographic dives…

read more >

“Josh Bersin of Deloitte believes the cost of losing an…

read more >

Watch the On-Demand Webinar Below! Diversity, equity, inclusion (DEI), and…

read more >

Watch the On-Demand Webinar Below! Are you looking to optimize…

read more >

HR's Definitive Guide to People Analytics Welcome to this comprehensive…

read more >

Maximize your Recruitment Efforts with HR Analytics In today’s fast-paced…

read more >

Strategic HR: Selecting a People Analytics Partner Empower your HR…

read more >

Level up Your DEI Efforts Welcome to “A Guide to…

read more >

Guide to Diversity, Equity and Inclusion Analytics Making progress with…

read more >

As an HR practitioner, you have access to an enormous…

read more >

It’s no secret that employee retention has skyrocketed to the…

read more >

Pay transparency and pay equity are top of mind for…

read more >

Is People Analytics the Real Reason You Haven’t Made More…

read more >

“How do I do people analytics?” Brilliant question. And one…

read more >

In today's data-driven world, businesses increasingly turn to analytics to…

read more >

Imagine a world where your employees are not just satisfied…

read more >

In today's fast-paced business landscape, employee retention is a top…

read more >

Long considered the ‘holy grail’ of talent acquisition metrics, quality…

read more >

Talent acquisition analytics are critical for today's savvy TA teams.…

read more >

The emergence of talent acquisition analytics is putting powerful information…

read more >

HR Industry Takes Notice of HireRoad's Powerful WorkForce Analytics with…

read more >

“83 percent of 924 companies surveyed globally have low people…

read more >

With today's constantly changing economic outlook, organizations are under constant…

read more >

Talent acquisition analytics is transforming high-volume recruitment in 2023 In…

read more >

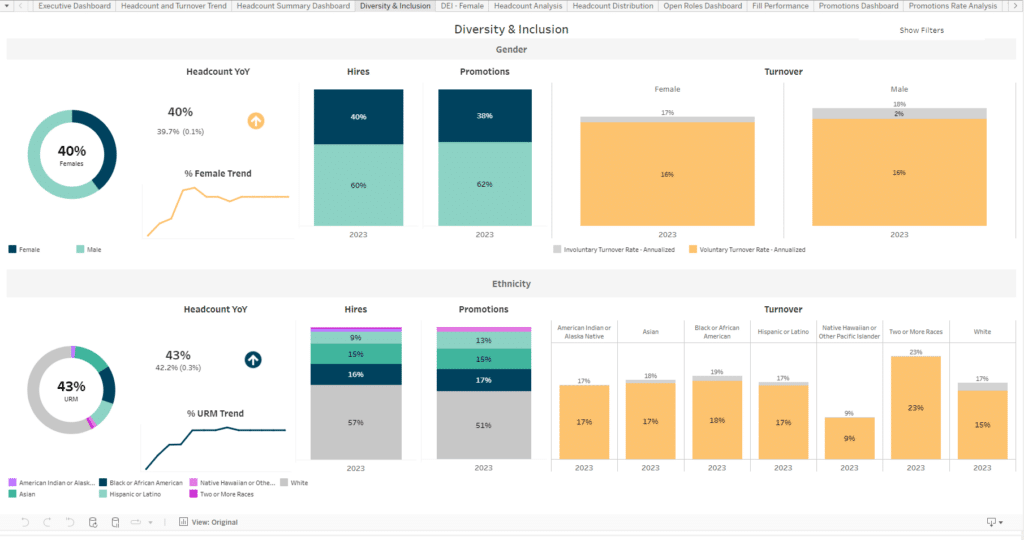

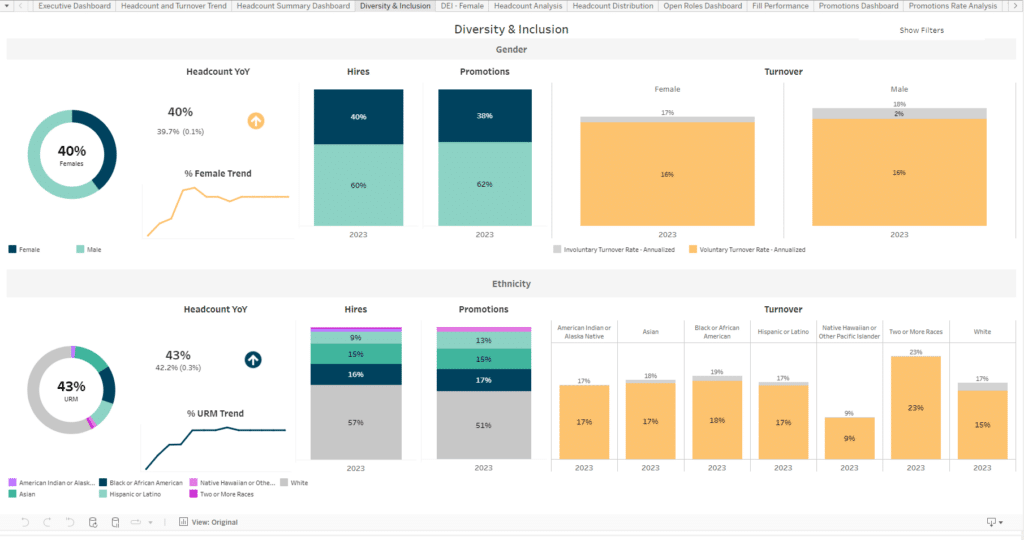

What's the difference between setting DEI targets and measuring their…

read more >

Over the past few years years, the area of diversity…

read more >

The latest breed of talent acquisition software is an appealing…

read more >

The quest to source the best talent acquisition platform can…

read more >

Accessing your Data from Source Systems Once you’ve identified an…

read more >

Despite discomfort with people analytics, HR's strategic importance as a…

read more >

John Pensom, co-founder of PeopleInsight by HireRoad, discusses diversity and…

read more >

Let’s look at one of our healthcare clients and how…

read more >

Data visualization because looks matter We’ve all been there. We're…

read more >

Do you know how your recruiting channels are performing against…

read more >

Diversity and inclusion are more than issues for compliance or…

read more >

Here are the 5 'must have' recruitment dashboards for today's…

read more >

We talked with Chris Gruttadauria, VP of HR at Alliance…

read more >

3 HR Issues that Workforce Analytics Can Resolve Major Draw…

read more >

No matter your company size, HR faces increasing pressure to…

read more >

Today, HR Leaders make use of analytics solutions to realize…

read more >

The Candidate Pipeline It can be a challenge to consistently…

read more >

In this blog we’ll introduce a change management approach…

read more >

In our opinion, there are two aspects that make data…

read more >

“ATS, HCM platforms, and other HR Tech can't deliver true…

read more >

As we discussed in last week’s 5 Minute Friday post,…

read more >

HR is no stranger to data and metrics and the…

read more >

Let's move onto the doing of people analytics - metrics,…

read more >

Engaging the Executives We’ve all been there – either as…

read more >

In our last post, we explored the value of visualizations…

read more >

In this post we explore the important role PEOPLE play…

read more >

5 Do’s and Don’ts for Effective HR Reporting Start Early…

read more >

“HCM platforms and other HR Tech can't deliver true people…

read more >

Wouldn’t it be great if we could just plunk in…

read more >

We have explored the value of visualizations in bringing workforce…

read more >

The Executive Scorecard Similar to the Executive Dashboard, but more…

read more >

We Believe that Talent Acquisition is Different than Recruitment. Much…

read more >

Updated on June 25, 2020 We’ve talked about HR…

read more >

In this blog, we look at some of the basic…

read more >

The Diversity Dashboard It's taken far too long but Diversity,…

read more >

In this blog we look at an 8-step plan for…

read more >

I had the pleasure of attending and speaking at the…

read more >

Of all the questions our Customer Success Team gets asked,…

read more >

In this micro-installment, take less than 4 minutes and listen…

read more >

In this micro-installment, take 4 minutes and listen to Al…

read more >

A key issue faced by HR is the lack of…

read more >

We hear it all the time and we get it…

read more >

DEI analytics can help businesses thrive in uncertain times (or…

read more >

There’s no shortage of aspirational narratives around the whys and…

read more >

A huge shout out to all the HR professionals out…

read more >

Are you onboarding new employees in the same old disorganized…

read more >

Do your current onboarding best practices consist of throwing your…

read more >

Your recruitment process and your employee onboarding process are two…

read more >

It automatically falls on HR recruitment teams to get really…

read more >

Diversity and inclusion in the workplace are broadly acknowledged as…

read more >

Technology abounds for HR. But there’s something singularly frustrating around…

read more >

Forbes’ expert panel member Heather Smith recently said, “In light…

read more >

Question: In the million-miles-an-hour HR recruitment landscape that’s already awash…

read more >

Question: In the million-miles-an-hour HR recruitment landscape that’s already awash…

read more >

HireRoad Acquires PeopleInsight Acquisition brings advanced data analytics capabilities to…

read more >

Aligning training with business strategy has never been a more…

read more >

Departments such as Operations, Finance and Sales all contribute to…

read more >

Finding amazing candidates in 2022 can feel like finding fur…

read more >

The current jostle to attract and retain talent is incessant.…

read more >

Strong yet supple recruitment strategies are a must for weathering…

read more >

Employee engagement. As a HR professional, you’re constantly thinking about…

read more >

The unprecedented events of the past couple of years have…

read more >

Compliance training is critical for so many industries and job…

read more >

Hiring for growth?! Can you imagine having a discussion about…

read more >

Having a continuously morphing HR tech stack is gold dust…

read more >

Recruiting in times of rife skills shortages isn’t for the…

read more >

Brian Knopp, VP at research and consulting giants Gartner, predicts…

read more >

“… when the top candidates are only on the market…

read more >

The Me Too movement has put workplace sexual harassment and…

read more >

Employees crave opportunities to grow more than almost anything. And…

read more >

L&D in small units makes for more effective eLearning courses…

read more >

Piece together a variety of training methods for a more…

read more >

5 Tips for Keeping Learners Engaged Bring on-the-job training to…

read more >

Just like Monopoly, building a strong and effective learning program…

read more >

Compliance Training In order for your organization to avoid regulatory…

read more >

A Guide to Employer Branding that arms recruiters with valuable insights…

read more >

Managing individual school recruitment centrally Nova Education Trust is a…

read more >

How to choose the best LMS for your business. Introduction…

read more >

Think long-term when selecting your learning management system Every business…

read more >

“Why do I need an LMS?” That’s a question that…

read more >

Incorporate a Learning Management System for eLearning delivery to help…

read more >

Digital technologies are changing so rapidly that keeping up with…

read more >

A learning management system can automate your quality management training…

read more >

Employees are your organizations greatest asset and successful employees are…

read more >

Delivering compliance training with a learning management system can help…

read more >

What benefits does a new LMS need to bring to…

read more >

Compliance training is a formal program that addresses policies, procedures,…

read more >

Start your new employees off on the right foot by…

read more >

If your organization has recently obtained a learning management system…

read more >

Remote and hybrid work is new norm. How can you invest…

read more >

Training videos are a great way to educate employees, customers,…

read more >

Selecting an LMS Technology has been changing how businesses and…

read more >

Building Blocks for a Successful eTraining Program There’s no single…

read more >

So you‘ve built an outstanding lesson using one of the…

read more >

Your employees are the backbone of your business. You need…

read more >

CBT and WBT Levels: A Discussion to Help Determine the…

read more >

With the increased use of virtual and hybrid employee learning…

read more >

A Brief Technical Overview That Answers the Question “What is…

read more >

Learn by HireRoadCase Study: Generac Overview To maintain its stellar…

read more >

The transition from in-person instruction to eLearning has provided great…

read more >

It’s hard to think of something that hasn’t changed in…

read more >

Your employees are your greatest asset. That’s why it’s essential…

read more >

Building a Business Case for Talent Management A strong business…

read more >

Glencore Case Study Glencore is one of the world’s largest…

read more >

Chandler Macleod Case Study Chandler Macleod has provided HR services…

read more >

Bureau of Meteorology Case Study Federal agency achieves rapid improvements…

read more >

Millennials currently comprise more than a third of the American labor force,…

read more >

The federal government onboarding process is designed to welcome new…

read more >

6 Steps for Employee Engagement in Your Talent Management Process…

read more >

Let’s face it, the stakes are higher than ever. Attracting…

read more >

For many people in Australia, 2020 has been the most…

read more >

Effective onboarding is the chance for your company to create…

read more >

A frequently cited report from Dell Technologies and The Institute…

read more >

Employee engagement has become an expectation of a modern workforce.…

read more >

The human resource department is the core component of any…

read more >

Industries’ technologies and business practices are constantly evolving. Hiring new…

read more >

In Part One of this series, I outlined the basic…

read more >

In many ways, today’s workplace is not for the faint-hearted.…

read more >

In a stable economy, strategies to reduce employee turnover become…

read more >

To succeed in today’s fiercely competitive business environment, an organization…

read more >

When considering HR solutions, organizations typically consider researching and investigating…

read more >

Defining talent is something that comes naturally to anyone working…

read more >

The federal government is a huge employer, hiring 200,000 people…

read more >

Talent acquisition is about the right candidate for the right…

read more >

A Sports Team Analogy on Talent Acquisition: Step 1 In…

read more >

High employee turnover rates are pushing organizations to recalculate their…

read more >

An empowered workforce needs these seven performance management factors Once…

read more >

Great teamwork can be a company’s ultimate competitive advantage. Being…

read more >

While 2020 proved that large-scale remote working is a viable…

read more >

Effective training and development start with a solid learning strategy.…

read more >

10 Engagement Ideas to Build a Thriving Workplace Achievement and…

read more >

You’ve read The Recruiters Guide to Applicant Tracking Systems and…

read more >

Within the HR and Recruitment space, occasionally a “horror story”…

read more >

Remote working has seen a rise in security risks with HR…

read more >

If there was ever any confusion about where onboarding begins…

read more >c In this article, we take a specific look at…

read more >It’s said you never get a second chance to make…

read more >

The pile of forms that new starters need to complete…

read more >I’m free. But, are you free? Is everybody on…

read more >Have you ever counted how many emails go backward and…

read more >

There’s an overwhelming range of tools of the recruitment marketing trade…

read more >The fact of the matter is it’s costing businesses more…

read more >Are you still wasting time and money on Multi-Poster Services? …

read more >

Digitising vetting practices in education is so powerful when you’re dealing with recruitment…

read more >New legislation from 11 November 2021 for Care Homes will…

read more >Digital technology in the workplace is transforming the way…

read more >

Let’s take a glance at the key categories of Screening and…

read more >If videos aren’t at the heart of your application process…

read more >

For any business, the benefits of adopting a Values-Based Recruitment…

read more >Are you stuck in a rut of using the same…

read more >

Candidate shortages mean you need to think outside the box…

read more >

Helping one of the UK’s largest supermarkets move to people-centered,…

read more >

The current pressure on HR recruitment teams is as high as it’s…

read more >

Amidst this climate, many in-house recruitment teams are thinking about alternative ways…

read more >